Tax Policy Center Claims Trump Child Care Plan Favors the Rich

Although most of President Trump’s policies have greatly divided the country, one policy that everyone can agree upon is lowering the cost of childcare. However, what they don’t agree on is how to make that happen. So far, his proposals have been well received by the right and not so much by the left. Shocking, right?

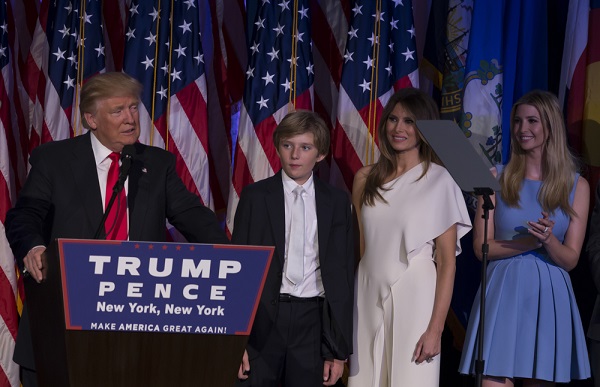

Trump made reducing the cost of childcare one of his campaign promises and even included it on his contract with America. His Daughter Ivanka Trump played a big role in creating the plan, which would provide more paid family leave for new parents and help increase the tax benefits to parents who have to pay for childcare, and even to some who don’t.

However, the problem is, according to the non-partisan Tax Policy Center, the president’s new plan will really only help the wealthy. The Tax Policy Center claims that 70 percent of the proposed benefits would directly help families that make at least $100,000. Meanwhile, more than 25 percent would go to anyone who earns $200,000 or more.

The plan also calls for a refundable tax credit for lower income families with parents that don’t end up owing any federal income tax. The most they could receive would be $1,200, but most families would end up with much less. Plus, parents who stay home wouldn’t be eligible for the tax credit, but wealthier parents that don’t work could still take advantage of the tax deduction.

http://money.cnn.com/2017/02/28/news/economy/donald-trump-child-care/

Top Tips for Planning a Successful Retirement

Top Tips for Planning a Successful Retirement Whether you already have one foot out the door, or you’re just starting your career, everyone should take the time to consider his or her retirement plan. It used to be that retirement was something you thought about when you turned 55, or maybe 45 at the earliest.…

Does Investing in Art Pay Off?

Many high-net-worth individuals have a strong interest in investing outside of the usual stock market. There are all kinds of things people can invest in, including luxury cars, real estate, horses, jewelry and of course artwork. The artwork is one of the most common collection items that the wealthy invest in and many high-net-worth individuals…

How The New Tax Law Directly Benefits Families

How The New Tax Law Directly Benefits Families Since December 22, 2017 there has been a flurry of news articles all talking about the same thing. Taxes. Well, rather the new tax law that just signed, the Tax Cuts and Jobs Act (TCJA). One of the biggest winners of this new law is American families,…

How to Minimize Investment Taxes

How to Minimize Investment Taxes As an investor, your first priorities should be 1) to develop an asset allocation strategy that aligns with your investment objectives and risk profile, and 2) to select quality securities that support that strategy. Only after that’s done should you turn your attention to taxes and identify opportunities to improve…