How Will the New President Change Taxes for the Wealthy?

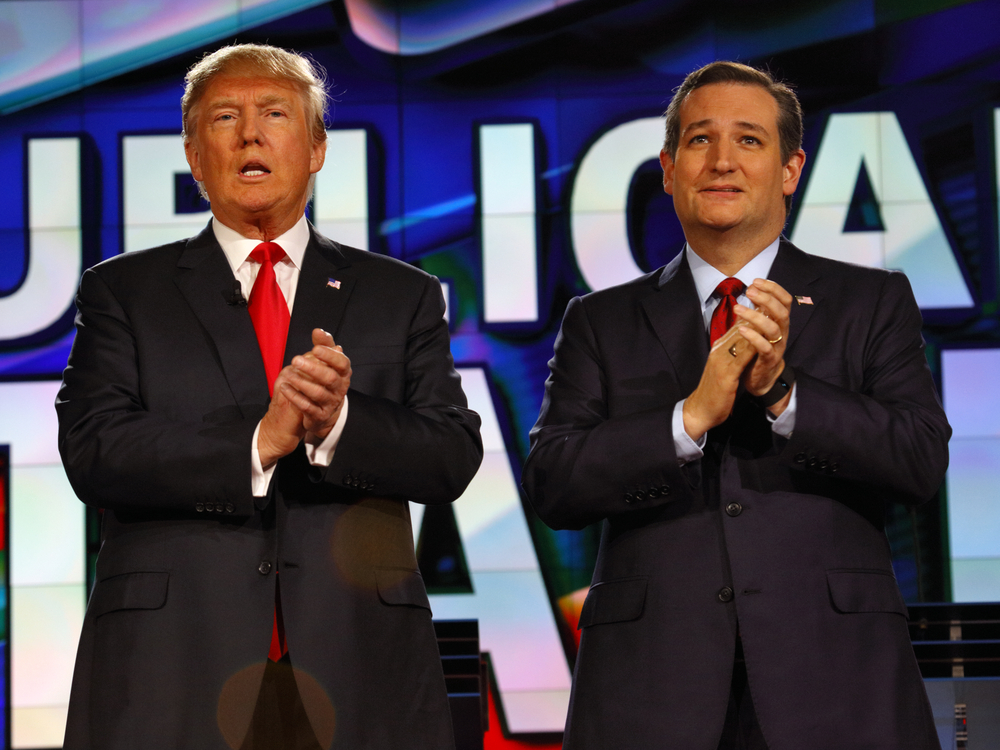

So which side are you on? Trump, Cruz, Clinton, Sanders, a write-in candidate, or are you still hoping for an optional third-party independent candidate? The fact is, when it comes to taxes, no matter which candidate you vote for, things will likely be changing for the nation’s wealthiest taxpayers in 2017. Whether or not you see those changes as positive or negative depends on which side you fall on.

The Tax Policy Center has released some interesting numbers that give a good picture of how the wealthy will be affected based on who is elected as our country’s next president. The general picture is that if a democrat candidate is chosen then the tax system would become more progressive and the wealthy would be hit harder. On the flip side, if a republican wins the nomination then revenue would be cut and the tax system would take on a more regressive approach.

Here is how the top candidates’ plans would affect the wealthy:

- Bernie Sanders – households that fall into the top 0.1 percent would see an increase of more than $3 million in taxes on average in 2017.

- Hillary Clinton – households in the same income level would pay an additional $500,000 more.

- Ted Cruz – households in the top 0.1 percent would see taxes cut by $2 million.

- Donald Trump – households in the highest income level would see taxes cut by $1.3 million.

Whoever the country elects as its next commander in chief, the majority of taxpayers will be affected one way or another. If you count yourself among the nation’s wealthiest, then you will feel that change even more, for better or for worse.

Clinton Offers Idea of New Tax Credit for Certain Businesses

While democrats and republicans will continue to fight it out over taxes and how to improve our economy, especially during the run-up to the presidential election, the battle generally stays the same. Democrats want to take more money, especially from the wealthy, and the republicans want to keep more money in taxpayers’ wallets. Surprisingly, however,…

If You Win the Big Jackpot Expect the IRS to Coming Knocking

Many people from all over the country enjoy gambling. Whether it’s big time poker, playing the slots or betting on sporting events, there are a lot of people who enjoy games of chance and the idea of winning something for nothing. Of course, most of the time, the house wins and the player walks away…

How Much Did California Taxes Affect NBA Free Agency?

The NBA finals are now in the rear view mirror, as is the league’s draft. In fact, the free agency period has largely ended as well, as far as the big-time impact players are concerned. It was an unusual year for free agency, as some of the most recognizable and marketable teams were mostly shut…

Which City Has the Nation’s Highest Sales Tax Rate?

Chicago is known as the Windy city and for good reason. However, thanks to a recent vote by Cook County commissioners, where Chicago calls home, it could now be called the tax city. That’s because Chicago, which already had a sales tax rate of 9.25 percent is jumping into the double digits after county commissioners…